Helen Collier-Kogtevs

APRA signal easing of bank lending Rules

In my last blog post, I talked about the potential negative gearing changes that would have been inflicted on us had Labor won the election. To my relief it didn’t eventuate, which means that the property market will begin to settle down.

In my last blog post, I talked about the potential negative gearing changes that would have been inflicted on us had Labor won the election. To my relief it didn’t eventuate, which means that the property market will begin to settle down.

To quote ex-Labor minister Graham Richardson “the mob always get it right” and regardless of whether you agree with the quote or not, I’m happy with the outcome.

And now that the election is over, we can all get back to normal.

Good news…

This week, in a move that will please investors who have been wanting to buy more investment properties, but couldn’t because of the stricter lending rules, APRA has announced that they are proposing to scrap the one banking rule that they put in place in late 2014.

This one rule has resulted in many investors ‘hitting the financial brick wall’, one of the primary causes why investors haven’t been able to buy more investment properties.

The rule relates to APRA requiring the banks to “stress test” all new loans.

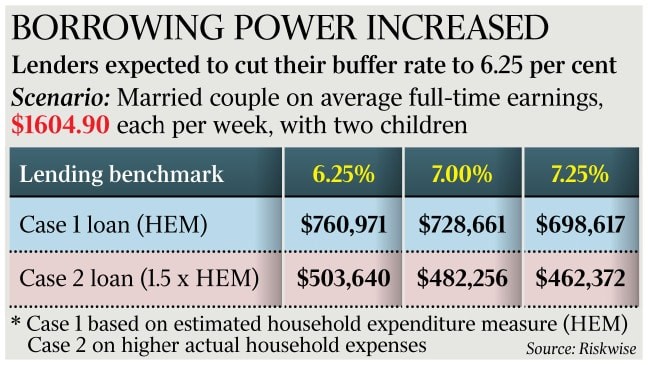

This meant that the banks had to assess all new mortgage customers on their ability to manage repayments as if the interest rate was at 7.25 per cent, which is much higher than the actual rate of less than the 4 per cent.

The impact of this decision will be that banks will be able to set their own minimum assessment rates, resulting in investors having more borrowing power and therefore being able to buy possibly one, two or even three more investment properties depending on your circumstances.

So if you are an investor who wants to expand your property portfolio but haven’t been able to because of this rule, then now is the time to review your investing strategy to ascertain the impact the rule change has on your ability to buy more investment properties.

Now is even more important than ever to work with a team of mentors who can support and help you navigate through the maze called property investing.

Now is even more important than ever to work with a team of mentors who can support and help you navigate through the maze called property investing.

With the:

- RBA signalling a future reduction in interest rates by up to 0.50% and

- The threat of changes to negative gearing, capital gains and Trust taxes alleviated with the return of the Morrison LNP government and

- Rents rising because of the pending shortfall in rental properties and

- The reported bottoming out of property price falls,

…now is definitely the time to re-energise your property investing strategy.

Are you stuck and not sure how to create your own personalised strategy?

Are you wanting to get back into the market but not sure where to start?

Talk to Us – Apply now and book a no-obligation call to see how we can fast track you today. Click here to apply.

Watch how Real Wealth Australia has helped one of its clients get out of a dire situation and onto a successful investing journey.

Click here to watch more success stories from Real Wealth Australia.

Helen Collier-Kogtevs

Share this post

Become a successful Property Investor