Helen Collier-Kogtevs

It’s official! Australia is now in a recession… now what?

As Australia has experienced three months of negative growth we are now officially in recession.

I wanted to share my thoughts on this as there are two dominate observations that I have made over the last few months that you might want to know about.

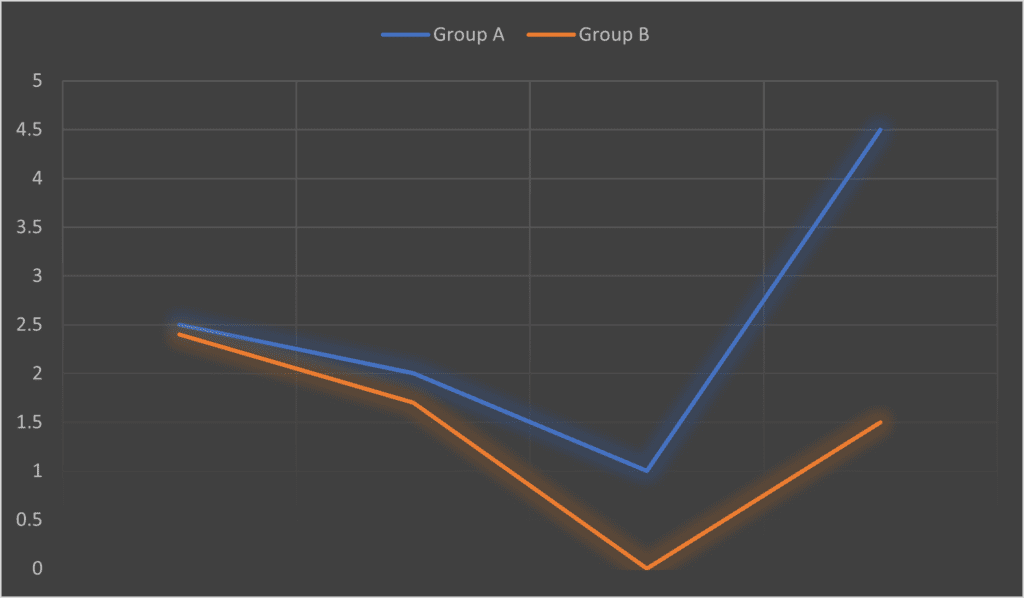

But first, you may have read my previous blogs where I share my thoughts regarding the economy and how we are going to experience a V curve bounce once are civil liberties are returned (especially for Victorians) and our lives go back to some level of normal before COVID-19 shut down the globe.

The question is, how long will this recession last? Well it depends on which bucket you sit in.

You see, there are two groups of people emerging from the impact of the shutdown caused by COVID-19:

Group A – those who have prospered, have a job or still running their business

Group B – those who have lost their job/business and are on struggle street.

We know that where there is an action, there is always an equal and opposite reaction, and this is what is happening now. To add to this equation, we have mindset playing its role in this game. Let me explain further…

For those who are in Group A are still working or running their business as usual, are doing really well, in fact, there are businesses (in particular industries) that are booming due to these lockdowns and restrictions, for example, supermarkets, food suppliers, some warehousing, transport, hardware stores like Bunnings and Mitre10, health care workers and good old Australia Post who deliver all our online orders. We also have public servants who have kept their jobs and are in fact receiving pay rises even in these tough times. With the exception of Victoria (who are in full stage 4 lockdown with curfews), for those who have a job/business in an industry that is thriving, life would be busy trying to manage the day to day same as before COVID-19.

However, for Group B, the scenario is quite the opposite. They have lost their job or business, struggling to meet mortgage repayments and manage life with the money they are getting from the government. This includes people who work in gyms, childcare, schools, airlines, travel agents, motels and clothing retailers… again especially in Victoria where all restaurants, pubs and cafes are either closed or open for takeaway only), retailers (other than food) are closed, schools, universities and the list goes on.

So Group B are on struggle street, doing what they can to get through this while Group A (busy as usual) are going about their business but… and this is where mindset kicks in. In light of all the negative media, restrictions, and no real end for COVID, Group A are holding back, are feeling like things are ok on a micro level but are concerned about what might happen next so are limiting their spending, growing their savings and are generally taking a cautious position economically. Even though they have the ability to spend, invest etc, they are choosing to play it safe and withhold. The mindset is negative or cautious and a real reluctance to do anything new right now.

Therefore, you have Group B doing their best to make ends meet, wondering when this is all going to be over and when it does, will still be financially impacted, and playing catch up, while Group A, in a more prosperous position, will get out and starting spending and enjoying life.

The outcome will be a quick bounce for Group A however, a slow and steady climb for Group B. How long will it take Group B to recover… well, that will depend on the damage caused to their financial situation as a result of COVID and the lockdowns.

For some, it will take a decade to recover, while others, a year or two once they get their jobs back, income flowing, and bills paid.

What do you do?

If you are Group B, look to put your mortgage repayments on hold and don’t be afraid to call all your service provides such as electricity, gas, internet/mobile phone companies, insurance, Foxtel, even school fees and any other service you have to negotiate a reduction, payment plan or hiatus during these difficult times.

If you are Group A, prepare yourself now and do the research for potential areas to invest in.

The latest data from Core Logic showed that last month, property prices around Australia fell by 0.4 per cent. I was really hopeful with this data as it’s not showing the expected massive decline in prices of 30 per cent across the board even though there are some suburbs around Australia that have experienced price drops. Overall, property prices are holding their value which is great news for investors because it means that they are not experiencing a negative equity position. Having said that though, it also means that there has been a price pull back making it attractive for investors to get into the market AND enjoy some discounts.

If you are one of the fortunate ones in Group A, now is a great buying time and with Melbourne and Sydney becoming more affordable, there are plenty of buying opportunities to be had. Be sure to select properties that tenants want to live in as this will protect you in the long term and minimize your risk of long vacancies.

But first, you may have read my previous blogs where I share my thoughts regarding the economy and how we are going to experience a V curve bounce once are civil liberties are returned (especially for Victorians) and our lives go back to some level of normal before COVID-19 shut down the globe.

Helen Collier-Kogtevs

Share this post

Become a successful Property Investor