Helen Collier-Kogtevs

Will the property market crash?

Australia is in lock-down, schools are closed, many people have lost their jobs or are working from home.

We must all exercise safe distancing, which means no social gatherings and as a result, the government has also shut down property auctions, and there are no more open for inspections allowed.

In shutting down the country, the government has also shut down our largest industry – housing. To use our Prime Ministers words he wants to “put the country into hibernation”, but will this cause property prices to fall?

Let’s start by taking a look at last weeks auction results.

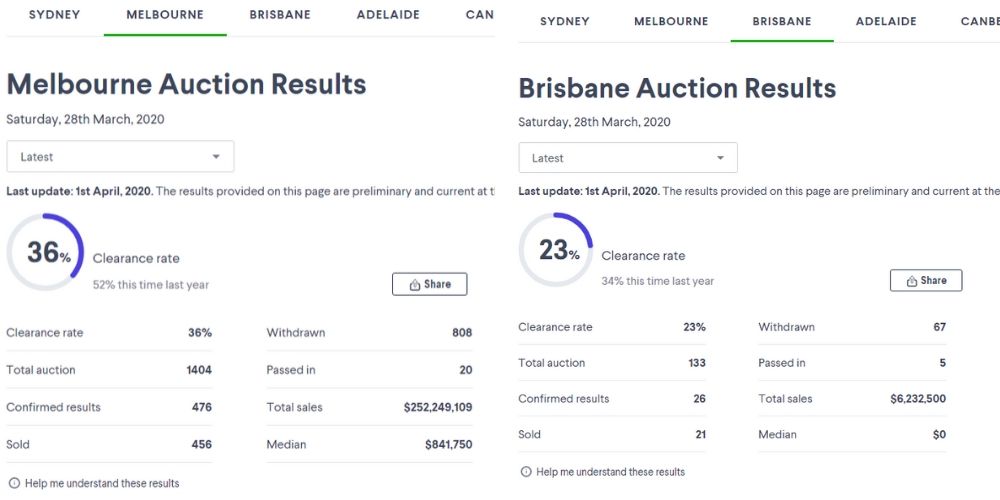

Up until last week, the market was doing well, the clearance rates for Melbourne and Sydney was well over 70 per cent with the other states not far behind.

However, the hibernation has caused auction results to fall dramatically and literally overnight.

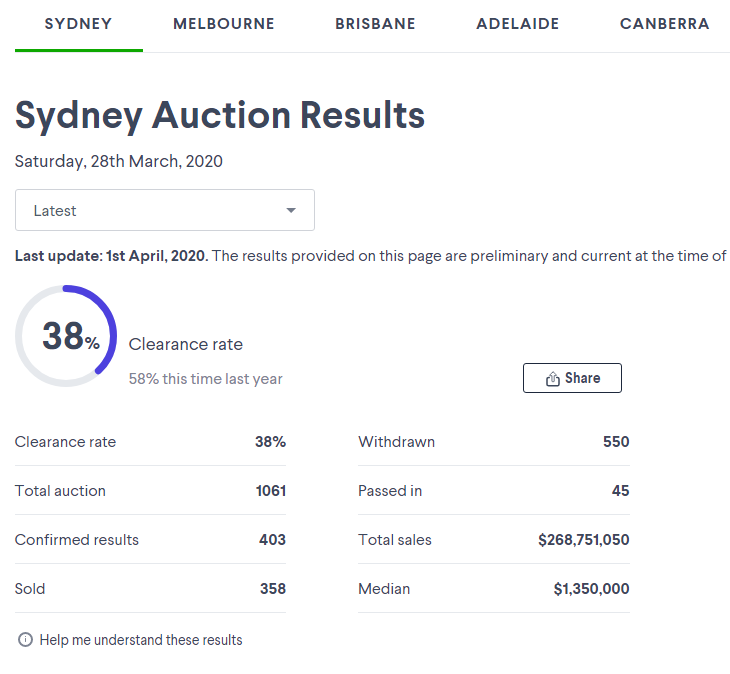

According to Domain, Sydney went from a 73 per cent clearance rate last week to 38 per cent this week and when compared to last year at this time, it was 58 per cent. It’s a dramatic drop isn’t it… and all happening very quickly. What is most interesting about the numbers though are the total number of auctions scheduled… 1061, however when you look at the number of auctions withdrawn, it was 550.

In the table below, let’s look at the ‘confirmed’ results of 403 (confirmed means auctions that actually happened), and the number of properties sold were 358, and exclude the 550 withdrawn.

So of the 403 confirmed auctions, 358 were sold making it an 89 per cent clearance rate. And of the 403 auctions, only 45 properties were passed in, which equates to 11 per cent.

Overall, do the numbers really look that bad?

Well, I know what you are thinking and yes there are lots of variables, however it’s clear that people who needed to sell – did sell and those who didn’t – withdrew their properties from the market.

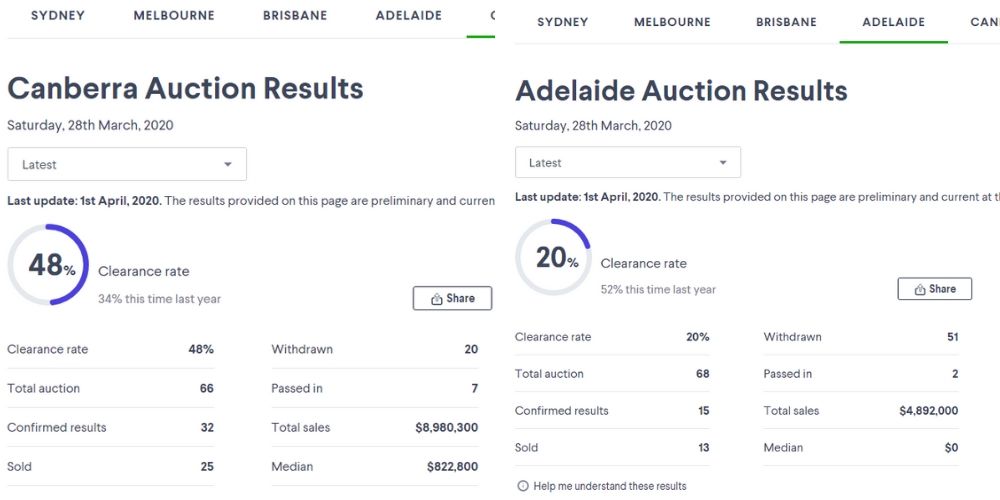

The same applied across the country.

It’s incredible what a difference a week has made to auction results, however these numbers to the auction results will continue to fall as live auctions cease. Lets see what happens over the coming weeks to the property market.

Does it spell the end for the property market?

In the short term yes, but it will bounce back because our population is increasing at around 400,000 per year and these people will need somewhere to live. Will properties continue to be sold during this time? Absolutely yes, simply because people still need to sell, while some buyers need to buy, albeit at a much slower pace.

I do see property prices falling if buyers exit the market causing property prices to drop but it won’t last long.

Normally a recession or downturn lasts 18 months to 2 years, however I don’t see this downturn lasting that long. We are in unchartered waters so you just need to ensure you can sustain your investments until things turn for the better.

Until next time, stay safe

Helen Collier-Kogtevs

Share this post

Become a successful Property Investor