Helen Collier-Kogtevs

Why foreign buyers aren’t behind our property price surge

New survey results publicised in March show foreign buyers make up 11% of property purchases in New South Wales, which has had the media going into hyper drive about unaffordability and Australian buyers missing out.

State and federal governments announced they’re going to hit overseas investors with even higher taxes as a crowd control manoeuvre.

But have foreign investors really been driving the affordability crisis?

Everyone has a theory on who is to blame for driving up house prices. Some say it’s because of low interest rates, some say it’s the fault of foreign investors, others say it’s because of the high number of Australian investors driven by the benefits of negative gearing. A few even say it’s the first-home buyers driven by first home owners grants. While others say it’s the high level of cashed up overseas migration into Australia creating housing demand.

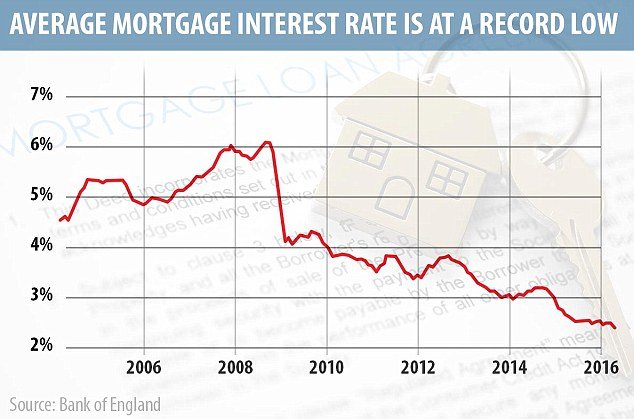

I believe the biggest single force driving house prices up are low interest rates closely followed by second time, owner occupier buyers. Low interest rates mean that you can afford to pay a bigger mortgage, until that is, rates start rising. Second time buyers are a huge portion of the market. They are generally settled in their high paying careers, cashed up, motivated to improve their lot in life and will pay top dollar to secure the right property.

Investors generally won’t buy these properties because the yields will, often, be too low. First home owners, unless assisted by family or friends, won’t be able to afford to buy them.

Despite all the media fear mongering, there’s no need to panic. These new reports are missing some vital details that show the situation is not quite as it seems!

Is the hype smoke and mirrors?

A little bit of digging shows that the alleged 11% share of the market is a highly skewed statistic.

Specifically, the number includes joint purchases with Australian buyers, and dual citizens. After removing those buyers from the equation, we’re left with 8% – and that number still includes permanent residents!

In addition, according to the survey, the rate of foreign investor purchasing is the lowest it’s been since 2012, which means overseas investment is slowing down.

And while media reports cast blame on these overseas buyers for our high prices, there are plenty of factors other than overseas investors that are contributing to price growth – record low interest rates being one of them.

Foreign investing has actually boosted our economy

Reportedly, the majority of foreign investor activity is focused on specific markets, in particular, off-the-plan apartment purchases.

To some degree, we should be grateful to our foreign buyers. According to comments by economic experts recently, their predominant off-the-plan activity has been a major boost to our construction industry and ensures demand for new supply for many years.

Furthermore, a recent Treasury report says foreign investors have only added between $80 to $120 per quarter to Sydney and Melbourne prices – hardly enough to cast all blame in their direction!

Foreign buyers have jumped onto the Australian property bandwagon because they realise the same thing we do: our property market is a powerful tool for generating wealth and income.

They are primarily buying premium off-the-plan units, whereas Australian investors focus on diversity. We understand supply and demand, we find the suburbs with strong growth drivers, where infrastructure is improving, and where improvements can boost capital instantly.

We closely monitor evolving demographics and pinpoint the suburbs that will increase in demand and value. You could say we’re not really shopping in the same store as foreign buyers.

Aside from foreign investment trends, here’s what else is happening in the world of property and finance:

Oversupply is less of a threat: Worries that the volume of inner-city construction will cause oversupply in the future are easing. New reports show construction will peak this year, and approvals will slow significantly in 2018.

Negative gearing windback: Proposed negative gearing changes are still the talk of the town in light of the upcoming budget announcements in May. The proposal to limit negative gearing to new builds has created a political tug-of-war. Investors will need to adopt a wait-and-see approach for now, and adjust their strategy when and if changes become official.

Discount interest rates revealed: The unwelcome news is that NAB announced their plans to increase investor loan interest rates by 25 basis points starting this month. However, the good news is that in a bid to lock in first homebuyers, lenders are offering discounted 2-year fixed-term rates. This offers entry-level buyers a better chance to get a foot in the market without fear of further rises for the short term.

Employment stronger in WA: Western Australia has shown resilience in its economic comeback. Homeowners and investors have breathed a sigh of relief over recent buoyancy in property prices, and now a drop in the unemployment rate – the lowest in 15 years – is improving confidence in the state’s recovering economy.

Stamp Duty off the cards in Victoria: The Victorian government has recently announced that from the 1st July 2017, Stamp Duty will not be charged for first home owners who purchase a property under $600k. A great initiative for first home owners but will mean nothing for investors.

Helen Collier-Kogtevs

Share this post

Become a successful Property Investor