Karen Van Maanen

Should I be renting appliances?

Have you ever sat home at night watching TV on that small screen wishing you could upgrade and you see an ad for appliance rentals? It looks so easy, a few dollars a week for that 60 inches smart TV with the latest technology. But is it as good as it sounds? What really is the true cost and is there a catch?

Have you ever sat home at night watching TV on that small screen wishing you could upgrade and you see an ad for appliance rentals? It looks so easy, a few dollars a week for that 60 inches smart TV with the latest technology. But is it as good as it sounds? What really is the true cost and is there a catch?

Do Your Research

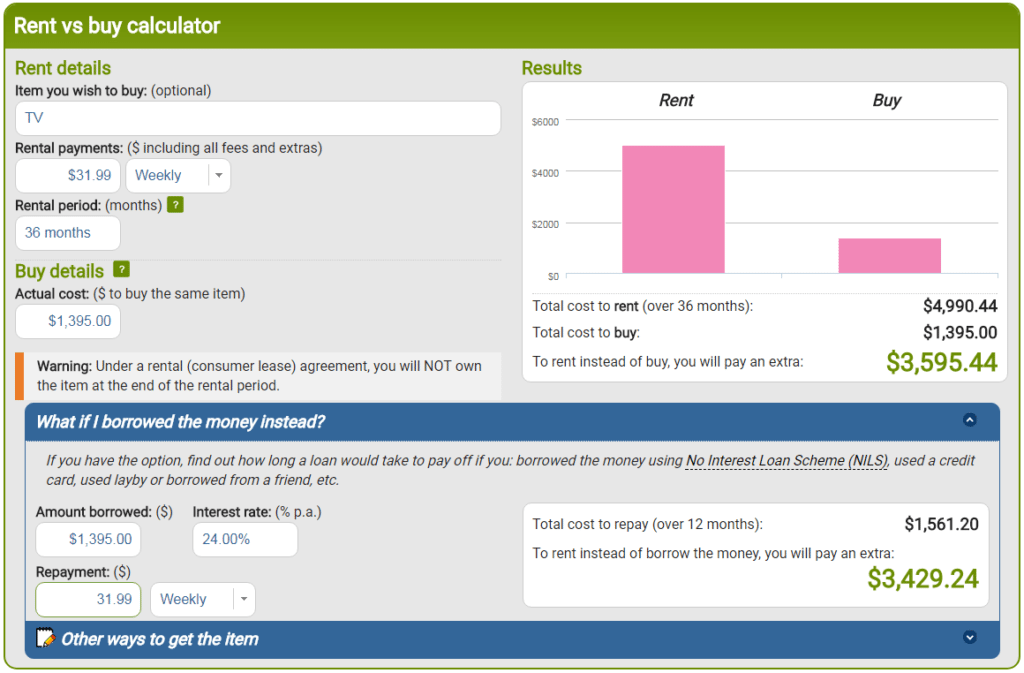

On the Australian Securities & Investments Commission’s (ASIC) Money Smart website, they have a number of calculators that will assist you in understanding how these type of financial decisions can impact your hip pocket.

Lets have a look at a scenario I am sure some people find themselves in.

Your TV is old and you would like to upgrade but you don’t have the money. You look on one of the many rental appliances websites and you discover that you can rent a TV for around $30 per week. You think to yourself you can easily afford this. But is there a catch? What would your true cost be?

Rent vs Buy! Which One?

Looking at the table below we see that $31.99 per week over a 36 month contract (3 years) this TV will cost you an enormous $4990.44 or enough to buy the same TV 3 and a half times over. Yikes!!!

Now imagine that you could purchase this item on a credit card even on a high interest rate at 24% and you diligently paid this off over 12 months the total cost of the TV would be $1561.20 or only $166.20 interest over the purchase cost of the unit.

But the best way to purchase that new TV is to save the cash and purchase the unit outright. In doing this it will also give you great bargaining power not to mention save you a bundle of cash over the longer term.

Don’t forget to comment below to share your thoughts and tell us if you have ever rented an appliance.

Sources:

https://www.moneysmart.gov.au/tools-and-resources/calculators-and-apps/rent-vs-buy-calculator

https://www.radio-rentals.com.au/tv/thorn-4k-tvs/lg-60-151cm-4k-smart-uhd-tv

https://www.harveynorman.com.au/lg-60-uj654t-4k-ultra-hd-led-lcd-smart-tv.html

Karen Van Maanen

Share this post

Become a successful Property Investor