Helen Collier-Kogtevs

How to find cashflow deals in less than 30 minutes.

I often have people say to me…

“Helen, I can’t find cashflow properties!”

Well, I’ve got my Educator hat on again and need to deal with this limiting belief.

I want to prove that it is easy to find cashflow deals and demonstrate how I found several deals in under 30 minutes.

Buyer Beware and Disclaimer

In highlighting these deals, I am NOT RECOMMENDING that you purchase them nor look to make a purchase in the area, rather, I prefer you look at what could be achieved if you think outside the square.

Now having said that, these deals will not work for many of you for a variety of reasons, the first being that it will be over your budget and second that it is a commercial finance arrangement which has more challenges than residential finance.

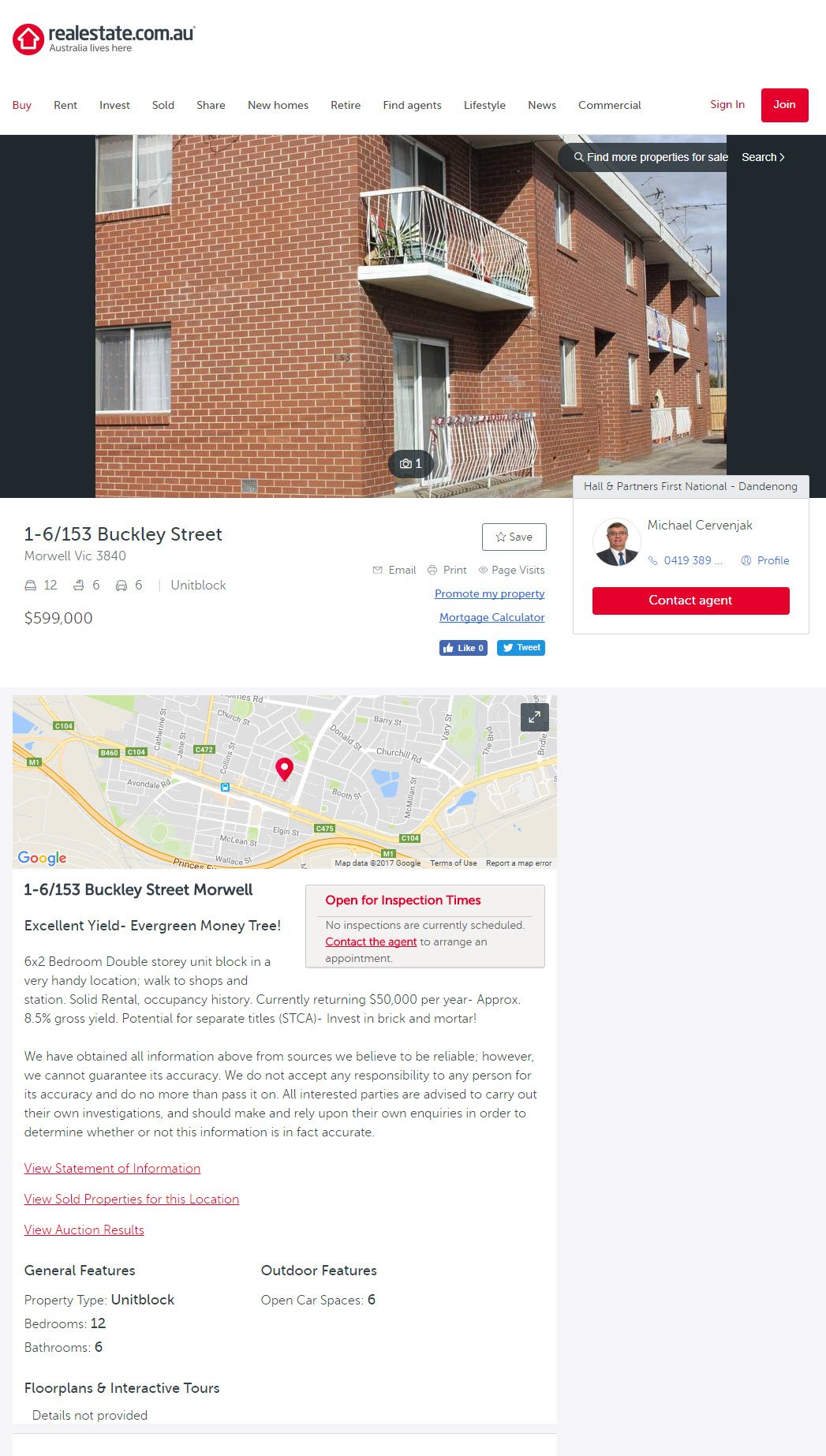

Here is a block of 6 units on one title

http://www.realestate.com.au/property-unitblock-vic-morwell-125568366

Now you will see that this property is not pretty but the numbers may in fact work. The property is on the market for $599,000 with a rent of $50,000 per year, which means a return “as is” of 8.3%.

There is also the potential to separate the titles (STCA approved) and this is where I think that this type of deal could get interesting.

Thinking Outside the Square

If you look at it face value, 8.3% is great cashflow right, BUT what if you could add value?

How would you do that? A renovation/rejuvenation or maybe strata titling?

You’d need to investigate if this is possible and the cost of doing a strata titling. You would need to ensure that the relevant fire walls are in place and that each property is separately metered. This could be a large expense, and if it is, then this could make a purchase like this unviable.

Let’s assume that the above is possible and the costs are reasonable, how would you proceed?

The first step is to ensure that you have completed your Extreme Due Diligence (this is what I teach my students), in the area to ascertain that a purchase here would suit your goals, budget, buying rules and strategy.

In completing your Extreme Due Diligence, you would need to see what industries are supporting the town, who are the large employers, what infrastructure is in the town, along with future planned infrastructure.

Further to this would be the added layer of Extreme Due Diligence on the property and what it could be worth once separating the titles has been completed.

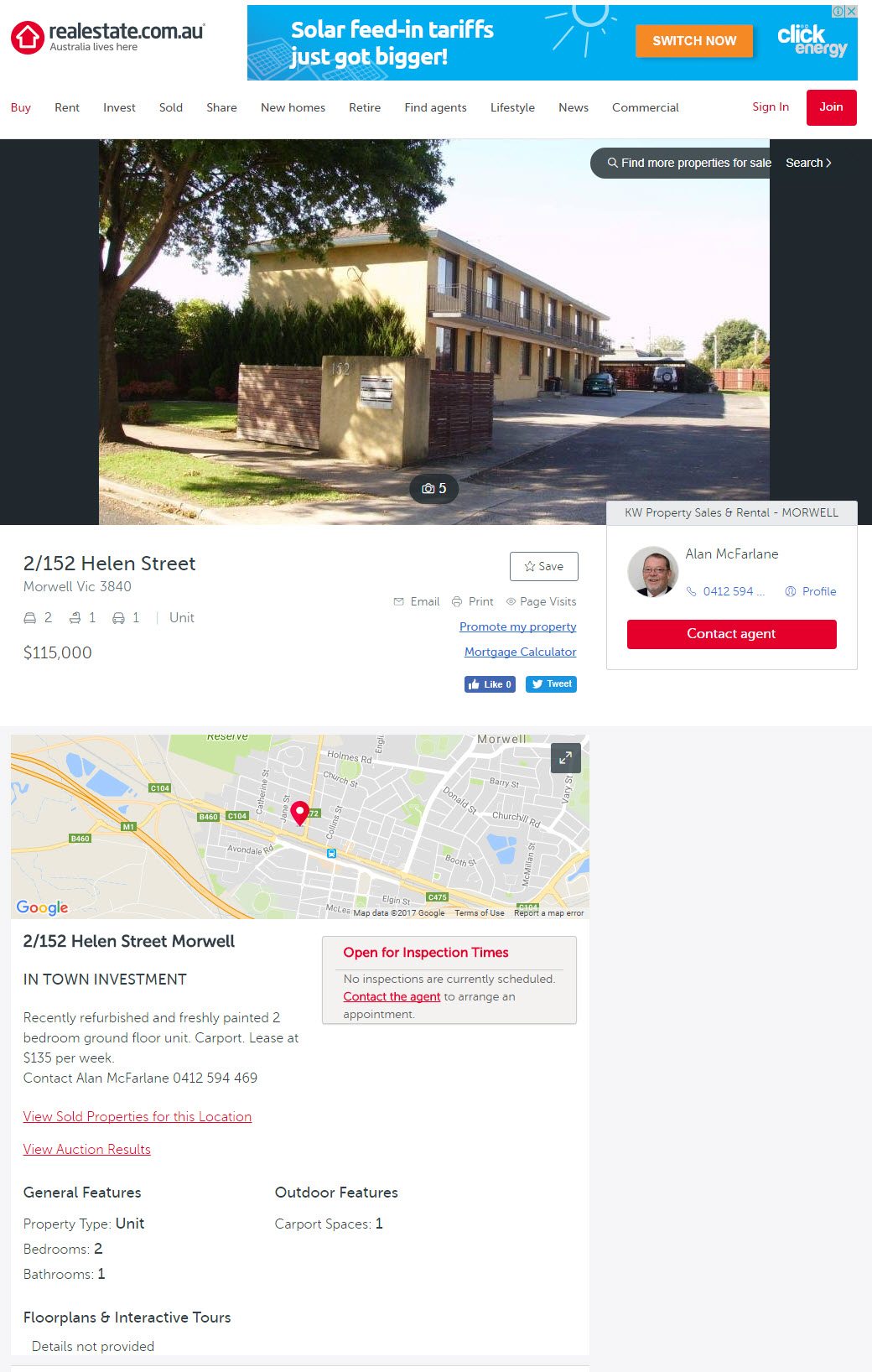

There is a property that I found within 1.1kms (thanks to Google Maps) that is a good comparison.

http://www.realestate.com.au/property-unit-vic-morwell-113678195

What you will see here is a very similar type of property on the market for $115,000 (2 bedrooms, 1 bath unit). Using this as a comparison to the other units in the block of 6, it could mean an instant increase of $90,000 on the project by separating the titles alone!

Now if you could negotiate the purchase price from the advertised $599,000 to say $550,000, this could leave you with $140,000 in equity, less any of the relevant expenses.

But I hear you saying it is a commercial deal and yes, it would need to start out that way, but once the titles are separated then you might be able to refinance back to residential lending and draw out your equity to go again.

Alternatively, you could sell a couple of the units to reduce the debt and have a much greater cashflow on the property.

Image What You Could Achieve With Your Investing If You Had Me And My Team Behind You Every Step Of The Way.

If you are thinking about applying and are still sitting on the fence, why not apply and have the interview so you can discover for yourself how we would work together and if and how we can genuinely help you. There’s no obligation either way, so what do you have to lose????

Better to find out than to live and wonder. 🙂

Until next time, happy investing!

Cheers

Helen

Helen Collier-Kogtevs

Share this post

Become a successful Property Investor