Helen Collier-Kogtevs

Are ski resorts a good investment or just a lifestyle choice?

Many of you may have seen my recent Facebook video posts where I was on a reconnaissance trip to Mount Buller to ascertain if buying a property in a ski resort would make a solid investment or be a costly lifestyle choice.

The traditional snow season runs from the start of June until the first week in October however this really depends on the weather. In a good season, the snow may last well into spring but in a poor season this could significantly be shortened and so too would your income.

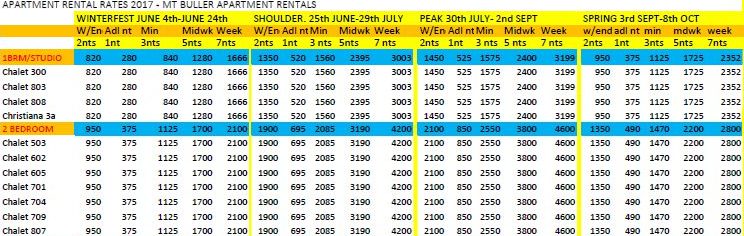

For any of you who love to ski, it may also be that you’d want to personally use the property and again, this is going to impact your bottom line. So, let’s have a look at some of the accommodation prices that I uncovered during my trip.

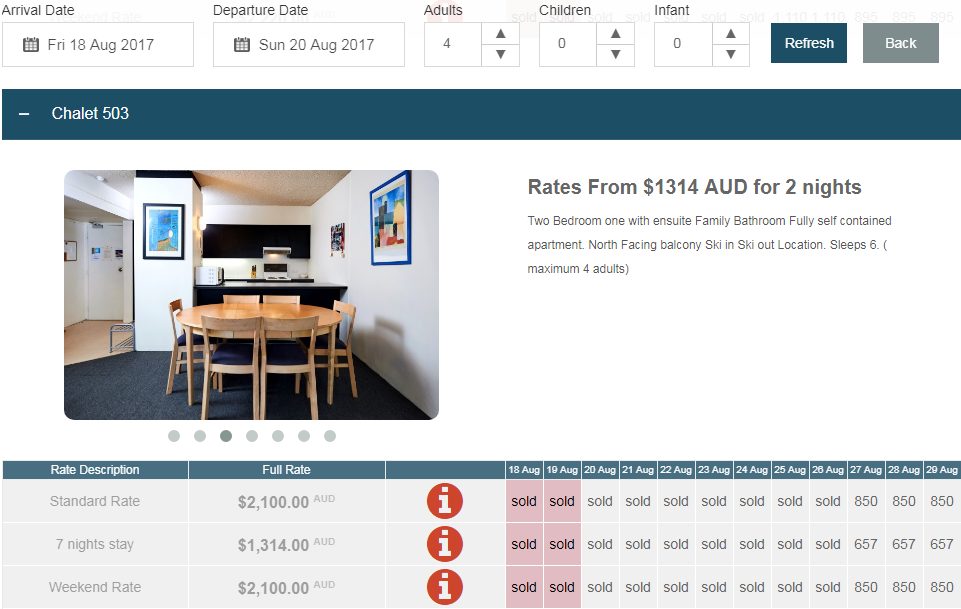

In using Chalet 503 as an example, it includes 2 bedrooms and 2 bathrooms and assuming that it could be fully let for the entire season, then this would give you an income of $64,300 based on the above table.

Now you’d have to say that this is an impressive amount of income for only four months of the year. But what happens to the numbers if you rented the apartment on weekends only for the four months?

This would result in your income dropping significantly to $29,600.

You could also expect that you may get some income in the off season however for each time you personally use the apartment, you would further limit the amount of income you receive.

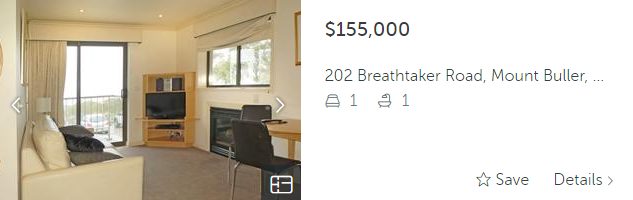

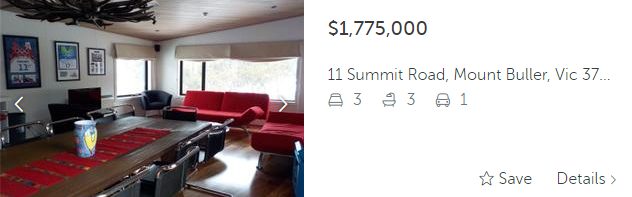

So, let’s have a look at what is currently on the market on realestate.com.au and prices start at $155,000 as of 15th August 2017 and go up to $1,775,000.

In looking at what’s for sale, I was also able to gather further information on costs that may be incurred with these types of investments. One agent advised Property Management fees are 25%.

Yes, you read that correctly!

Property Management fees for ski resorts are 25% …compare this to the property management fees for your normal residential property, this figure would be around the 8%.

The agent also advised that the Body Corporate fees for Chalet 503 was $4,057 per year.

Plus…

If you are holiday letting this investment, you would incur the following costs in addition to the 25% management fees:

- Linen hire at $15 per single bed and $25.00 per queen bed

- Laundry costs of $32 plus GST for 4 beds, up to $64 plus GST for 8 beds

- Cleaning is $50 plus GST per hour

… and they charge $13 plus GST just to check the room each day for any damage.

Another property that I made enquiries on had Body Corporate fees at an eye watering $11,156 per unit and the land tax was $13,652.

You can see that there are massive costs involved with the management of the property and can you imagine if you have a change of occupants every second day, these additional costs could be crippling.

For the 2016-2017 financial year, Chalet 503, had an income of $48,700 with expenses of $21,200. This did not include any interest costs so I suspect that once you add these in you may in fact have a negatively geared property.

One critical point with a purchase on the mountain is that the land on Mount Buller is leasehold. What this means is that you don’t own the land – only the building. The land is leased from the Victorian Government until the 30th October 2061 so part of the Body Corporate fees that you will pay will be a site rental charge along with land tax and other associated fees.

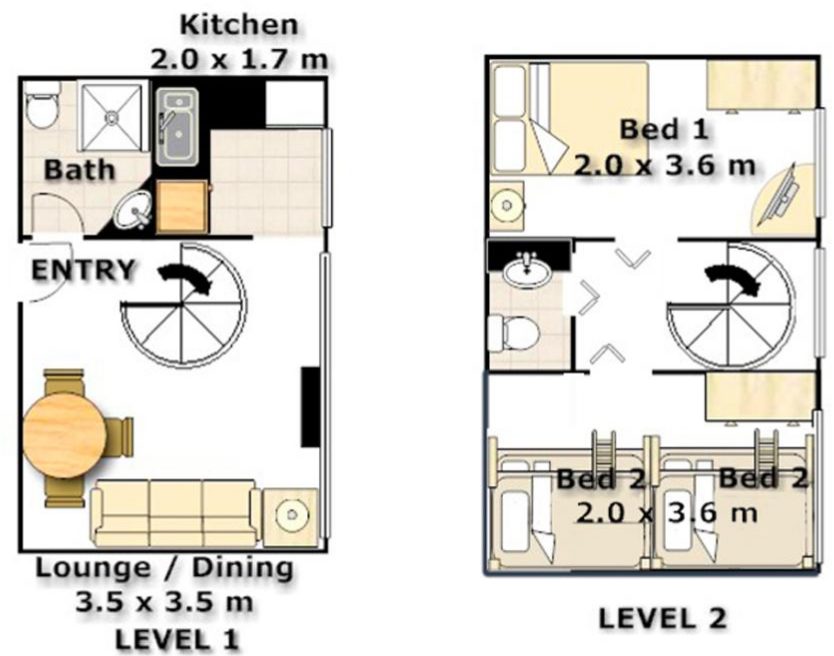

The other critical point and possibly the biggest hurdle is being able to fund a purchase here. In doing further research on this aspect it would appear that lenders have very conservative Loan to Value Ratios for this area and it could be that you would have to put in a 40%-50% deposit on a purchase in Mount Buller.

Another sticking point for the lenders will be the size of the apartments with many of these being under the desired 50sqm or above. As you can see from the image below, very compact living.

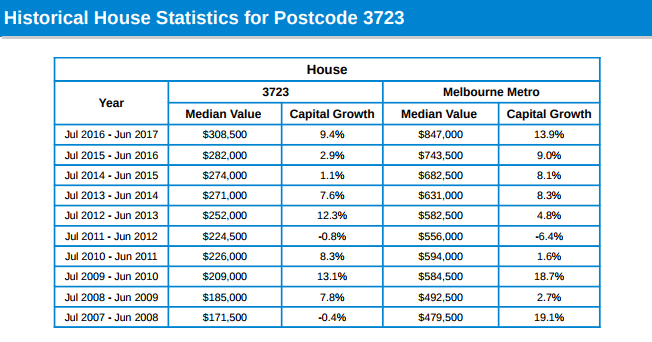

When doing my research, I always try to ascertain if the area is potential for investment and worthy of further investigation by looking at how it has performed over time and how is it predicted to perform in the future.

In obtaining a suburb report for Mount Buller, in 5 mins, I discovered that the property market is too small to provide accurate statistics, making it really difficult to ascertain how the area has performed in the past and how it will perform in the future. In other words, it has a higher risk profile.

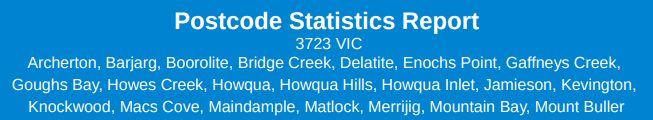

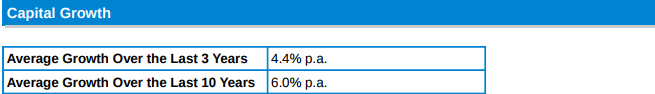

If we look at the Residex Postcode Statistics Report for 3723 this covers many areas and does not give accurate information.

Take a look at this…

What we see in the above tables is that Mount Buller is part of a greater area that has performed at 6% per annum over the past 10 years but you will not be able to accurately tell if properties on the mountain have performed in the same manner.

This makes it difficult to compare apples with apples and use the data to assist with making qualified financial decisions.

For me, I always want to crunch all the numbers when considering my next property purchase… from looking at costs, to income, to looking at past, present and future data… all these paint a picture.

In summary …

Are ski resorts a good investment or just a lifestyle choice?

The answer is an over-whelming no fix …it’s a lifestyle choice.

For me the outgoings are far too high, the income is unpredictable and I can’t validate the capital growth potential.

Here’s my tip:

As for a lifestyle choice, make sure you can easily sustain your purchase without the need to rent it. And make sure that if anything happened and you lost the investment, it’s important that it doesn’t send you to the wall financially.

As for ski resorts being a lovely place to visit – absolutely.

I’m more of a sun, sand and sea type of gal, but I don’t mind the odd visit to the mountains.

Until next time, happy investing.

Helen.

Helen Collier-Kogtevs

Share this post

Become a successful Property Investor