Helen Collier-Kogtevs

How Many Properties Do You Need To Retire On?

It’s Not As Many As You Think!

Introduction

Of all of the questions I field from investors, this has got to be one of the most common. How many properties do you need in your portfolio, in order to retire from your day job and live comfortably on the income from your investments?

My answer? It depends. Because, truly, it does!

It depends on your goals, your lifestyle, your living expenses, your family situation… it really depends on a great number of factors. For instance, if you are a homebody who is happy driving a 10-year-old car and you don’t have children, your lifestyle expenses will be far lower than someone who wants to travel frequently and update their car every two years. Both lifestyles are perfectly okay – but it’s your own personal situation that will dictate your ideal journey forward.

It depends on your goals, your lifestyle, your living expenses, your family situation… it really depends on a great number of factors. For instance, if you are a homebody who is happy driving a 10-year-old car and you don’t have children, your lifestyle expenses will be far lower than someone who wants to travel frequently and update their car every two years. Both lifestyles are perfectly okay – but it’s your own personal situation that will dictate your ideal journey forward.

In the past, I have published a report called How to Buy 10 Properties in 10 Years & Retire on $100,000 plus. In that report, I explained how property investors, including my husband and myself, had implemented the 10 in 10 strategy to build a property portfolio, which allowed us to retire on a healthy annual income.

Since then, I’ve chosen to work in my Real Wealth Australia business not because I need to – thanks to my smart investing, I certainly don’t need the cashflow – but because I’m passionate about educating and empowering fellow Aussies to achieve the kind of results I’ve found possible, using my proven systems.

In recent years, as market and lending conditions have changed, I decided it was about time I put together something new, exciting and inspiring that reflected the current property landscape.

I hope this article sparks a fire in your belly and gives you the motivation you need to jump into property investing, to take advantage of the unique conditions that make 2018 the perfect time to begin (or continue to build) your property portfolio.

First Things First: Why Property?

What can I say – I love property!

It’s a tangible asset, something you can see and touch, and just as importantly, it’s something you can insure. Historically, property has been shown to outperform the share market and other investing avenues, if you play your cards right.

In my 10 in 10 report back in 2014, I explained how, by purchasing 10 great properties in 10 years, you could replace your employment income and retire comfortably on the positive cashflow from your investments.

But what if I told you that you don’t need a huge portfolio of 10+ properties in order to retire comfortably? What if you could replace your income by buying just four or five properties?

But, hold on – what about the property market?

Isn’t it on the way down?

Personally and professionally, I just don’t buy into the media hype that the property market is about to bottom out – because I’ve been in this game a long time, and I can tell you that this doom and gloom propaganda is nothing new.

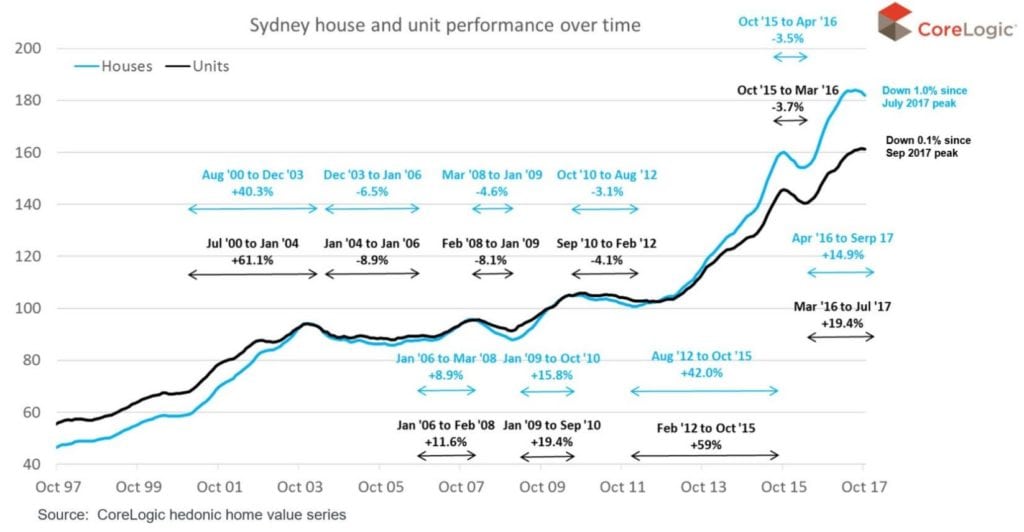

Take a look at this graph from CoreLogic, showing the ebb and flow of the Sydney property market over the past 20 years:

Can you remember the panic-stricken newspaper headlines at the time, claiming homeowners were set to lose hundreds of thousands of dollars? I can!

But as you can see, values picked up steam again before too long and the crisis experts saw coming never actually happened.

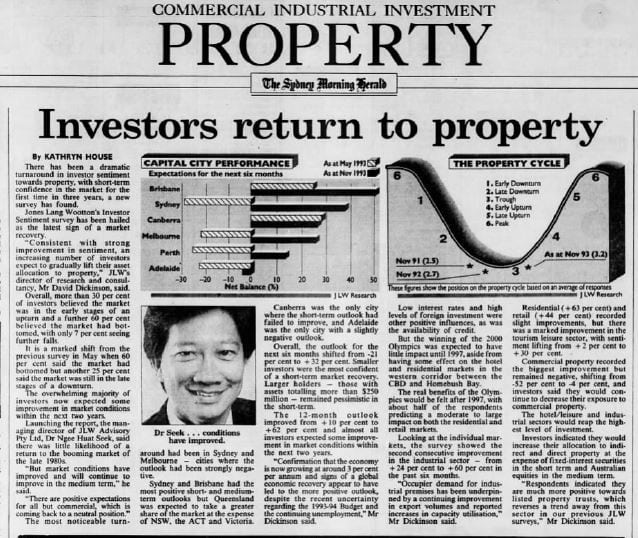

You see, these doomsday prophecies are nothing new…

I can’t count the number of times over the years I’ve seen headlines on the front of major newspapers claiming that the property boom was over – yet time and time again, they are proven wrong.

We may be entering a period of slower growth right now, but those conditions will be temporary. Soon enough, the market will gather momentum again, just like it always has – and property values will begin to climb.

The same goes for the argument that property has become inherently unaffordable. Way back in the 1970s, the Sydney Morning Herald was claiming that buying a home in the Harbour city had become out of reach for the average Australian. Yet people kept buying properties, and they’restill buying today, at prices which would give those journalists in the 1970’s a heart attack!

Lending and Finance in 2018

I’ve had many clients contact me, panicking about the APRA changes announced last year, and with the banking Royal Commission that is currently underway they’re worried more restrictions are coming.

What about the recent changes to investment lending?

As an educator, I have to say that I’m actually really pleased about these changes. Why? Because a big part of what I do with my students is help them become better money managers – and these changes mean lending in the future will be more responsible and ethical. I think this is a great thing!

After all, it means that borrowers will only be able to take on debts that the bank is convinced you have the capacity to repay. Where’s the downside to that?

How do these changes affect you?

Banks don’t want you to default on your mortgage – for a start, its terrible PR for them! And even if they force you to sell, chances are they won’t make all their money back. So it’s in their interest, as well as yours, that they only approve you on a loan to purchase a property you can afford.

Many people I’ve spoken to recently are worried about the APRA changes, thinking it will be impossible for them to secure a loan or grow their portfolio in an environment of tight lending restrictions. But that’s simply not true!

Banks are still lending and many, many people are still borrowing large amounts of money – but they’re borrowing smarter, which in my opinion, is a great thing.

Banks are still lending and many, many people are still borrowing large amounts of money – but they’re borrowing smarter, which in my opinion, is a great thing.

Here’s why….

We have a stable economy. We’re not headed for recession any time soon. We have a stable government; even if we’re not always huge fans of the pollies we have representing us in parliament, we know there won’t be a military coup or civil war in our future.

We are not headed for a GFC-style crisis in the property market, as our market is nothing like that of the US back in the 1990s, and though some cities may be softening, we will ride out these times just as we have ridden out sluggish periods in the past.

I actually think this is a blessing in disguise for investors. Historically, securing finance has been far too easy and irresponsible lending has resulted in many investors finding themselves in hot water, burdened by loans they can no longer afford.

The APRA changes have capped the amount of interest-only and high-LVR loans banks can approve while the Banking Royal Commission is highlighting the need to crack down on rogue brokers and lenders with dodgy practices and forcing them to look more carefully at their processes and in turn the real capacity of borrowers to repay.

But, it also means that when you DO secure a loan, it will be well within your means and you won’t be taking an enormous financial risk.

So, what should investors be doing to adapt to these changes?

For a start, I’m going to be super-honest with you: I don’t advocate get-rich-quick schemes, I’m not here to sell you a fanciful story about making a tonne of money from nothing, without even trying.

For a start, I’m going to be super-honest with you: I don’t advocate get-rich-quick schemes, I’m not here to sell you a fanciful story about making a tonne of money from nothing, without even trying.

I’m about smart, strategic investing based on solid foundations. I’m about playing the game of property investing strategically, like you do when you play chess. And one of the most important ways to play strategically, is learning how to manage your money wisely.

That’s why I teach my students all about budgeting and managing their cash flow, not just the latest fads and trends in property investing.

So not only will you be able to build a property portfolio which will allow you to replace your income and retire, you’ll also have acquired the money management skills needed to make the most of this opportunity, rather than fall down the financial rabbit hole that so many succumb to.

Think of this as an opportunity, not an obstacle…

This is your chance to consolidate your money management skills, take charge of your budget and put yourself on the road to financial freedom.

When I talk to budding investors, many of them don’t realise just how detrimental credit cards can be to your borrowing power. Sure, most of us know that having high levels of bad debt will impact how much we can borrow. But do you know that your credit card limits reduce your borrowing power, EVEN IF YOU’RE NOT USING THEM?

That’s right, even if you don’t owe a single dollar on that emergency credit card, the bank will assess your debt level based on the current limit – and for every $5000 of credit you have available, your borrowing power may be reduced by up to $25,000! Isn’t that crazy?

So many people don’t know this, until they get knocked back for the loan they need to buy the perfect investment property, and by that time it’s too late to do anything about it. The bank has already said no and someone else is picking up the keys to the property they had their eye on.

So, simply paying down your debts isn’t enough to maximise your borrowing power – you also need to cancel those credit cards, or at the very least have the limits reduced to the absolute minimum.

If you can scrap your high-limit cards and keep just one card for emergencies, with a low credit limit, your borrowing power will increase – and you’ll be a much more desirable candidate for an investment loan.

Budget 101: Time to Tame Your Expenditure

Thanks to the APRA crackdown and in the wake of the banking Royal Commission, gone are the days when banks would throw money at investors. These days, you’ll have to prove your income and outgoings with the appropriate paperwork, bank statements and pay slips, going back at least three months, if not longer.

Until now, most lenders used one of two measures of average household expenditure to assess whether an applicant (or applicants) could afford a mortgage. The figures they used, known as the Household Expenditure Measure and the Henderson Poverty Index, give a baseline cost of living for households, depending on the number of adults and children.

If your spending exceeded these figures, it was easy enough to fudge the numbers a little and have the bank assess your loan using the HEM or HPI, rather than your actual expenditure.

But not anymore…

It’s increasingly looking like the banks will be requiring proof of your living expenses.

For high rollers who love to splash the cash, this is pretty dire news. But for sensible money managers who have a good grip on their spending, it’s actually very encouraging.

It also means you won’t be competing with Mr Rich Spendalot at the next auction you attend – he won’t have the preapproval to outbid you, now that the bank is looking at his finances with a higher degree of scrutiny. At an auction, competition between bidders drives high prices. So your chances of getting that awesome property at a great price just got better!

Moral of the story? Get your expenditure under control now, so you’re one step ahead of your rivals.

Overall, I think these changes are a really positive thing, and here’s why…

If you can’t live within your means, you’ll never experience true financial freedom – just ask all those millionaires and billionaires who’ve ended up bankrupt and destitute, because they couldn’t rein in their spending. There are countless stories of people who had the world at their feet, more money than most of us could ever imagine – yet ended up with nothing, because they lacked financial literacy and self-control.

Good money management isn’t just a vital skill for your own life. It’s also a powerful legacy to leave your children.

By teaching them the fundamentals of budgeting, saving and investing you’re setting them up for financial security into the future – what an amazing gift! With your example, they can avoid making mistakes and falling down the financial rabbit hole, and instead enjoy a prosperous, secure life.

Now, you may think you’re money-savvy, but your current strategies could be holding you back.

I couldn’t tell you how many self-employed people I’ve met, who brag about their teeny-tiny tax bill. They think they’re onto such a clever strategy, exploiting every deduction within the limits of the law to minimise their taxable income, as much as possible, leaving them with more cash in their hand at the end of the financial year.

I couldn’t tell you how many self-employed people I’ve met, who brag about their teeny-tiny tax bill. They think they’re onto such a clever strategy, exploiting every deduction within the limits of the law to minimise their taxable income, as much as possible, leaving them with more cash in their hand at the end of the financial year.

Sounds great, right?

Wrong!

Lenders assess your capacity to repay a loan based on your taxable income. So if you’re trying to maximise your borrowing power in order to grow your portfolio, shrinking your taxable income can be a huge mistake.

Sure, you’ve got a little extra spare cash floating around and you’re paying barely any tax, but what use is that if you can’t secure the finance for an investment property?

Smart investors know that there is a delicate balance between minimising tax liabilities and keeping your taxable income high enough to qualify for the lending finance you need.

The Rental Boom

I believe we are about to enter a rental boom.

In England, the annual housing survey in 2015 revealed that the number of 25 to 34-year old’s renting their homes had more than doubled since 2004, with 48 per cent of young Brits renting from private landlords.

A decade prior, almost 60 per cent of that age group were buying their own home. But, thanks to rapidly-rising property values, many Millennials have been priced out of the market and are forced to rent long-term.

I believe the same phenomenon is happening in Australia right now. Combine this with the fact that lenders are about to get a lot more stringent about who they’ll extend mortgages to, and how much they’ll loan them, and you have the perfect storm for a rental boom. This equals low vacancy rates, healthy rental yields and a long line of prospective tenants hoping to secure one of your rental properties. Translation? There really is no better time to invest.

I believe the same phenomenon is happening in Australia right now. Combine this with the fact that lenders are about to get a lot more stringent about who they’ll extend mortgages to, and how much they’ll loan them, and you have the perfect storm for a rental boom. This equals low vacancy rates, healthy rental yields and a long line of prospective tenants hoping to secure one of your rental properties. Translation? There really is no better time to invest.

In fact, the 2016 Census showed that the number of renters in Australia is already on the rise and that was BEFORE the major markets peaked and housing became unaffordable for so many. Just look at the data:

Dwelling tenure by type in Australia, 2011-2016

| Tenure type | 2016 (total) | 2016 (%) | 2011 (total) | 2011 (%) |

| Owned outright | 2,565,695 | 31.0 | 2,488,149 | 32.1 |

| Owned with a mortgage | 2,855,222 | 34.5 | 2,709,433 | 34.9 |

| Rented | 2,561,302 | 30.9 | 2,297,458 | 29.6 |

| Other | 78,994 | 1.0 | 70,070 | 0.9 |

| Tenure type not specified | 224,869 | 2.7 | 195,213 | 2.5 |

Source: ABS 2016 Census

We may be coming to the end of the property boom in the major capitals, but I believe we are about to enter a rental boom.

Think about it…

Immigration is still happening at record levels, and these new Australians need somewhere to live! Buying a home isn’t going to be on their radar until they are settled in their new country, with the secure employment and credit history they need to qualify for a mortgage. So, that means they’re going to need rental properties.

At the same time, while the market in Sydney and Melbourne seems to be coming off the boil, prices are still out of reach for many young Australians. The result is that long-term renting has become the norm for this generation, as the struggle to save for a deposit is taking them longer it did ten years ago.

Sadly, thanks to the record-low interest rates we’ve been experiencing and the irresponsible practices of some lenders, should rates rise in the coming months and years (and they will), many homeowners are going to find themselves over-capitalised and unable to afford their mortgages. If they are forced to sell, they’ll join this ever-growing queue of potential tenants.

Where are all these Australians going to live?

In one of your investment properties, of course!

Will this rental boom last? Of course not, like all peaks in the housing market, it can’t go on forever. As property price growth picks up again and wages rise, the rental boom will cool off a little. But by the time this happens, your properties will have likely increased in value, and you’ll be able to enact the next stage of your retirement strategy!

Choosing the Right Investment Properties

I can’t stress enough how important it is to think like your prospective tenant when choosing a rental property. It doesn’t matter whether YOU love the property, or if it suits YOUR family or lifestyle – because you won’t be the one living in it!

I advise my students to do their research by speaking to as many property managers as they can, to get a real feel for the market in the area and what the tenants are looking for. Families will want to be close to parks and schools, while for professional couples, transport links to the CBD,

I advise my students to do their research by speaking to as many property managers as they can, to get a real feel for the market in the area and what the tenants are looking for. Families will want to be close to parks and schools, while for professional couples, transport links to the CBD,

A huge home with no off-street parking or a hazardous backyard isn’t going to attract a lovely young family. Likewise, an executive apartment off the beaten track, in a suburb without a train station, won’t.

You need to understand your market

Cater to the market, and you’ll minimise the costly vacancies that can make or break your investment. For each day your property sits vacant, awaiting a new tenant, you’re losing money. Not to mention the costs of re-advertising and re-letting, and the risk that always comes with taking a chance on a new tenant. Make your property desirable to long-term tenants, and headaches like these will be few and far between.

The questions you’ll want to ask the agents include:

- How many bedrooms and bathrooms are popular?

- What difference can an extra bedroom make in the rental return you can expect?

- How important are things like dishwashers, air conditioning and ducted heating to tenants in the area?

It may be worth spending a little time now to install some of these comfort features, if it helps you lock down a long-term tenant and avoid long periods of vacancy.

Once you’ve spoken to at least three or four local property managers, you’ll be left with a pretty detailed shopping list on the type of property you should be on the lookout for – helping you to streamline your search and cull unsuitable properties using online search criteria.

Another great thing about getting to know the local agents is that they’ll be the first to know when their landlords are thinking of selling an investment property. You may find they’ll give you a heads up when a property which meets your requirements is about to come up for sale, helping you to beat out other potential buyers and buy it for a good price.

Don’t be afraid to widen your search

Don’t make the mistake of looking only at Melbourne and Sydney and allowing the cooling market in these cities to tarnish your view to the nationwide situation. In South Australia and Tasmania growth is still strong in the current market and there are loads of positive stories coming out of regional areas, too. Do your research and explore all your options before you decide where to buy.

Don’t dismiss the benefits of developing a site, either. I’ve worked with many students over the years who have gone down the development path with plenty of success. In fact, recently a lovely young couple we have been working with, who’ve amassed an impressive portfolio of properties, got approved for multi-dwelling developments. With my help, they have set themselves up to pull the trigger on their development strategy to increase their wealth this year.

These are ordinary, everyday Australians, just like you.

The Magic Number

So let’s get to the point – how many properties do you need to retire?

In the current market conditions, I no longer believe you need to buy 10 properties in 10 years in order to retire. Instead, I think you can replace your income and retire with just four or five properties – here’s how:

You spend the next couple of years growing your portfolio, by buying four, maybe five, fantastic properties.

You spend the next couple of years growing your portfolio, by buying four, maybe five, fantastic properties.

In 10 or 15 years’ time, you sell two or three of these properties, and use the proceeds to pay out your remaining mortgages. You’ll then have two properties that you own outright, and you can live off the rental income. The key here is ‘time in the market’, the longer you’re in it, the higher your return.

Let’s take a look at a couple of examples from my own portfolio…

Sixteen years ago, I bought a house for $250,000. It’s about ten kilometres from the Melbourne CBD and is now worth $1.2 million.

The following year I bought a townhouse for $300,000 and spent $50,000 renovating it. Fifteen years later, it’s worth $950,000.

Imagine if you had five of these, that would mean you would be sitting on over $5 million today! If you sold three of these properties at $950,000 each, that’s $2.85 million – more than enough to clear the five original $300,000 loans. This would leave you with two properties, worth nearly $2.5 million.

Assuming they were rented for $700 per week each, that’s $72,800 in rental income over the year!

Now imagine you begin building your property portfolio today, acquiring five properties worth $600,000 each over the next few years. If we take the conservative estimate that property values double every 10 years, in a decade from now your portfolio of five $600,000 properties, worth $3 million today, will be worth at least $6 million.

If you sold three of those properties for $1.2 million each, you’d be able to pay off all your mortgages and enjoy the rents on the remaining two properties as cashflow!

A word of warning on high-density apartments…

One thing I would urge you to steer clear of is investing in high-rise apartments. Not only is there a glut of these coming onto the market thanks to the construction boom of the past few years, but they can also be very costly investments.

The strata/body corporate fees in some of these high-rises can be upwards of $10,000 to $15,000 per year, meaning you’ll need to charge $300 per week in rent simply to cover the fees!

Instead, follow the strategy I’ve given in this report to find highly desirable investment properties that renters want, to save yourself the money and hassle that comes with apartment ownership.

HOW CAN REAL WEALTH AUSTRALIA HELP YOU BRING YOUR STRATEGY TO LIFE?

Real Wealth Australia isn’t about get-rich-quick schemes or fairy tales of having it all. It’s about real, sustainable wealth that can replace your income and liberate you from your 9-5 grind – it’s about freedom!

There are authors, property experts and finance gurus out there who would like you to believe differently. They’ll tell you that, with their method, you CAN have it all, you don’t need to sacrifice a single thing! To me, that’s just plain irresponsible and unrealistic.

There are going to be a few sacrifices along the way, that’s life.

But you’re building something so much bigger!

I would love to be a part of your journey, so please get in touch to find out how can help you get the ball rolling on your wealth-building property investment plan. From education to mentoring, beginner investors to seasoned property moguls, we love to share our knowledge.

Contact us today on 03 9432 1699.

Btw, It’s hard to imagine that a $500,000 property today would be worth $1 million in 10 years’ time but if it’s a great property, it will grow. When I started investing, I couldn’t imagine my properties ever doubling but now that I’ve gone through a few property cycles, I can see and have experienced this actually happening.

So the moral to the story – buy great properties that you can afford and stay in the market long enough to enjoy the growth. If you stay in the market for 2-3 years expecting to get rich, you might be disappointed.

I hope you have enjoyed reading this article as much as I have writing it. I would love to hear your thoughts on it and any feedback you may have.

Leave a comment below if you have any questions. I look forward to hearing from you.

© 2018 Real Wealth Australia

All rights reserved. No part of this publication may be re-produced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying or otherwise, without the prior written permission of the publisher. No responsibility can be accepted by the author or publisher of this book for any action taken by any person or organisation relating to any material contained herein. Property investment is a complex and changing field and all readers should seek independent, detailed and professional advice as to the relevance of any part of this material to their own specific circumstances.

Disclaimer

Helen is not an accountant, real estate agent, financial advisor or solicitor. Helen is an investor who is sharing information from research and her own personal experiences only.

The information is not intended to be a vehicle for the provision of investment and related advice to you. Helen is not giving you legal, accounting, investment, real estate, valuation or financial advice. The information contained in this booklet will not be effective unless you obtain appropriate independent professional advice and do the necessary research and due diligence in respect to your own personal financial position and lifestyle.

You must be cautious about making investments where your decisions are not based on sound research and independent professional advice as it is not only risky but can be disastrous.

Helen and her associated companies, including Real Wealth Australia Ltd are no way liable for any loss, damage or misunderstanding caused by mis-management of any information. Ultimately you will need to make the final decision yourself based on your situation, lifestyle and independent professional advice.

Helen Collier-Kogtevs

Share this post

Become a successful Property Investor