Helen Collier-Kogtevs

Brace Yourself for a Collapsing Property Market and How to turn it around

My recent blog article about property prices falling by 20% received an overwhelming response, both positive and some negative. Those most upset with me were the Queensland property developers trying to flog their sub-standard projects to unsuspecting Sydney and Melbourne investors.

And I’m sure you will agree with me when I say that the care-factor was low… lol.

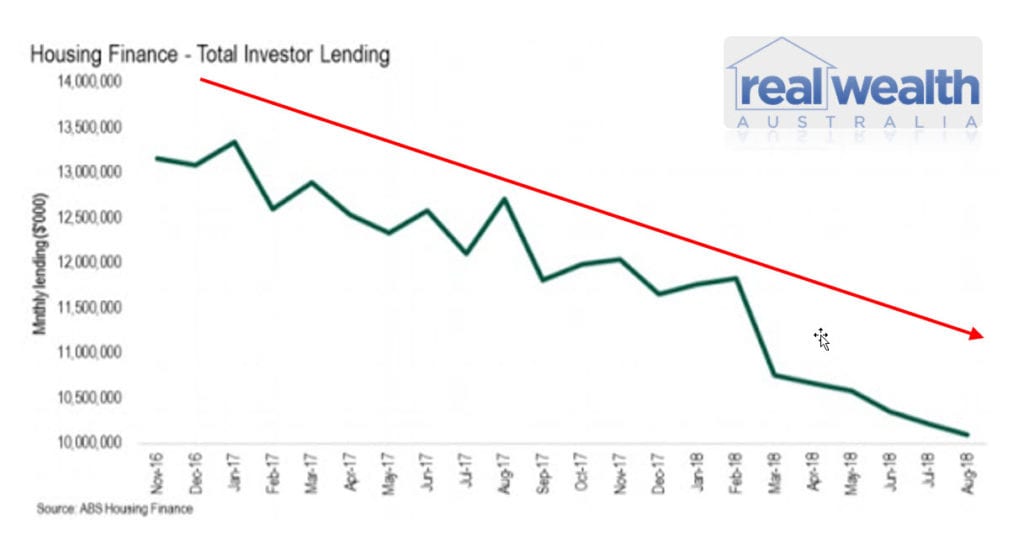

Anyway, the property investor lending market is rapidly collapsing (see graph below) and potentially drying up completely and when it does there will be dire consequences for people who rent.

Yes, I’m calling it as I see it and I have been saying for a while now that we are about to experience an explosion in rents… I’m already seeing it.

Let me explain…

Recently, the Australian Bureau of Statistics released the following data:

Have a look at the steady decline in Investor Lending. This is a warning sign of what is to come.

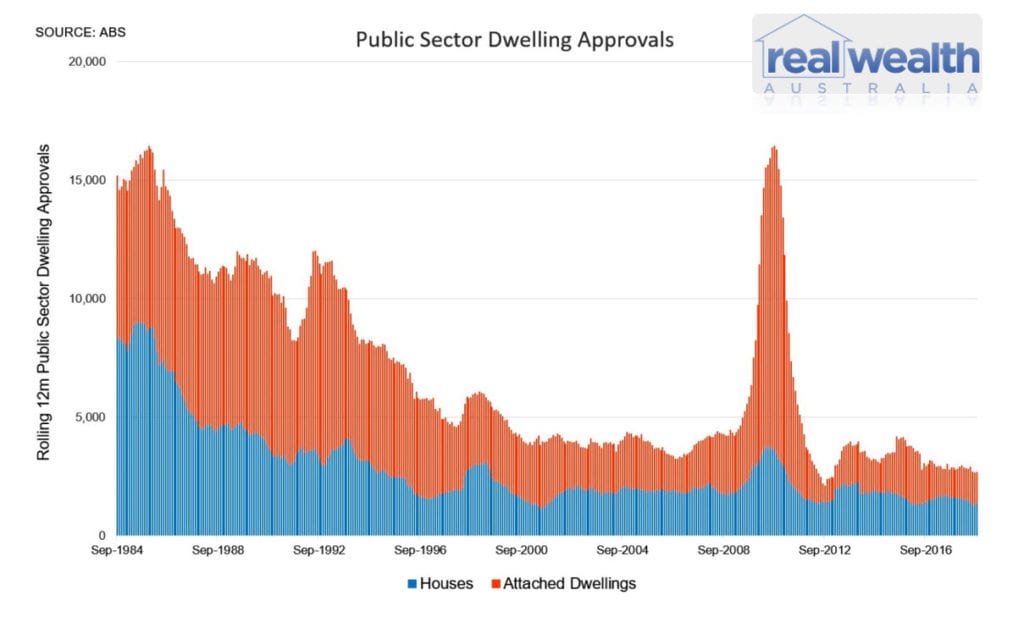

And have a good look at the Public Sector Dwelling Approvals from Australian Bureau of Statistics.

Source: Australian Bureau of Statistics

You’ll note that since the 1980’s, public dwelling approvals have dropped from around 15,000 to around 2,000. Most of the construction over this period was to repair or replace existing dated housing with little additional new stock being added.

In order to cover the decline in government involvement in public housing, governments of both persuasions encouraged private sector investors to provide the necessary public housing. This buck passing of public housing to the private sector was very deliberate as it meant that governments didn’t have to make massive capital outlays to build new public housing, nor did they have to provide the necessary massive infrastructure to manage these properties and lastly, they could never again be criticised by tenants for increasing their rent.

The outcome has been that in today’s society, the community is now heavily dependent on private sector investors to provide its public housing needs. And given the current high levels of immigration, why is the property investment market drying up and how is the government going to cover the rapidly growing shortage in public housing?

Rental boom fast approaching

After all, conditions for investing in property are at their peak. This is due to the growing number (around 35%) of people who rent, lack of affordability for those wanting to buy, interest rates at their lowest in living memory (sub 4 per cent), readily available finance and low vacancy rates.

So why the sudden fall in property investing?

The answer… to a large extent is “market uncertainty” brought about by several real and perceived factors, including:

- tighter lending controls brought about by APRA and the banking Royal Commission,

- the banks being “spooked” by APRA and the Royal Commission into reviewing/revising their lending practices,

- the federal government changes to depreciation,

- Labor’s proposed tax changes to negative gearing, capital gains and Trusts

- and other yet to be announced changes.

Is it any wonder that property investors are running for cover?

So where do I think the property market heading?

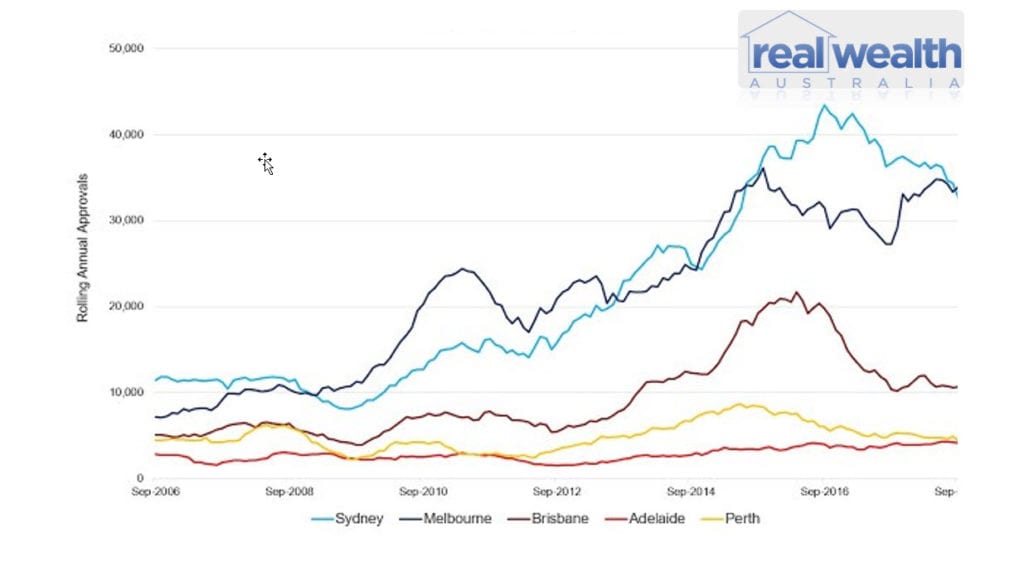

Well let’s take a look at the residential construction approvals (see below) because they are an indicator of where future rental stock levels will be coming from.

Sydney house and unit construction approvals are way down from a year ago and are still trending south. Brisbane unit construction has been down for some time however Melbourne’s unit construction is bucking the trend and is holding up.

Overall residential construction works right across the country are trending down.

Source: Australian Bureau of Statistics

In summary we have uncertainty in our lending market because of APRA, the banking Royal Commission, the banks in panic mode and Labor party policy. There is a definite downward trend in our residential construction approvals, there is a burgeoning increase in population, and there is a trending down in investor lending and hence participation.

This will lead to a shortfall in public rental housing which is tantamount to saying that we are heading for a massive explosion in rents as available spare rental stock is rapidly soaked up by an exploding population.

We are already seeing this happening in the ACT and Hobart. The ACT has a vacancy rate of just 0.5% and is experiencing stratospheric increases in rents as renters fight for the limited available stock and Hobart isn’t far behind. This rental explosion will, I believe continue over the next 12 months to two years as rental property stock dries up, investor sentiment declines and the population increases continue on their merry way.

Stop immigration you might say, but it’s not going to happen because neither the Liberals nor Labor have an appetite to do so and the reason why is that population increases equate to increases in government revenue, economic growth and increases in GDP.

With all this going on, everyone is a little spooked at this time, which is having a grave impact on the investor market and it will be tenants that end up also paying the price. Not an ideal scenario for our political parties in the upcoming federal election.

There are voters in every household, including renters, and I am sure they will not be happy with the shortage of rental properties available and ever-increasing rents. The last time we had a shortage of rentals, it took about two years before it corrected itself.

Constructing new rental stock won’t happen overnight so renters be prepared for massive rental pain that will continue for years to come.

Both political parties need to heed this warning and act swiftly or risk prolonged renter pain as rents inevitably skyrocket. Unfortunately this situation has already progressed further than it should have and like a cruise ship, it won’t be able to be turned around overnight. There will be a lot of renter pain before the market returns to normal.

Good news for investors

Do you already own investment properties?

Well, now is the time to be making the most of your yields, after all, it wont last forever so make hay while the sun shines.

Given that current conditions are almost perfect for investing in property, now is the right time to be investing in property. The only thing to note is that your buying strategy may need to changed or tweaked to accommodate the current and prospective legislative changes in a falling market.

More about these changes in my next blog.

What’s the message here?

Investors… don’t give up, we have an opportunity here to negotiate when buying a property and bag ourselves a great deal. While most people are clearing out of the market, you can be negotiating some great discounts and enjoy the growth on the next upswing.

You also need to make sure you comply with all the new changes the lenders are implementing. Make sure you don’t over extend yourself (financially speaking), borrowing less than what you need and leave some in reserve for rainy days.

Keep your buffers full – don’t use it for holidays or upgrades to your home and make sure you can handle your mortgage with ease even when interest rates go up.

One of the biggest mistake’s investors make is buying in an overheated market. Same goes in a falling market when real caution needs to come into play when selecting a property, but there are bargains to be had as prices fall and investor competition dries up. This is where getting an education in property investing could save you thousands.

I believe that there will be price drops across all states during this current downturn so learning to understand the fundamentals of property investing, will hold you in good stead for the next cycle.

During a property boom, almost everyone makes money but it’s the savvy investors that have mentors and understand what they are doing that make the biggest profits during a down turn. And with all the industry changes, its important that your team of experts are across it all, understand your personal objectives and support you in achieving them.

Remember that is you buy an investment property before Labor’s policies are legislated then it’s understood that the changes to negative gearing and capital gains tax, will be “grandfathered” and will not apply to the properties that are purchased before the legislation is enacted.

I’m sharing with my students that I reckon there might be a rush on property purchases before the next election as investors try to take advantage of the grandfathering of any new legislation. So for all of those who have property, I want them to benefit from the property cycle.

Some have suggested that Labor may delay the introduction of these policies, but I believe there is little to no chance of this happening because they will need the revenue from these policies to help pay for their high taxing $220bn election promises.

It is fantasy land stuff to suggest that Labor will drop these policies so now is the time to get in and take advantage of the negative gearing and capital gains provisions while they are still on offer AND negotiate on all your property deals to ensure you build in your capital growth before the next property cycle upswing.

Until next time, happy investing.

Helen Collier-Kogtevs

Share this post

Become a successful Property Investor